0

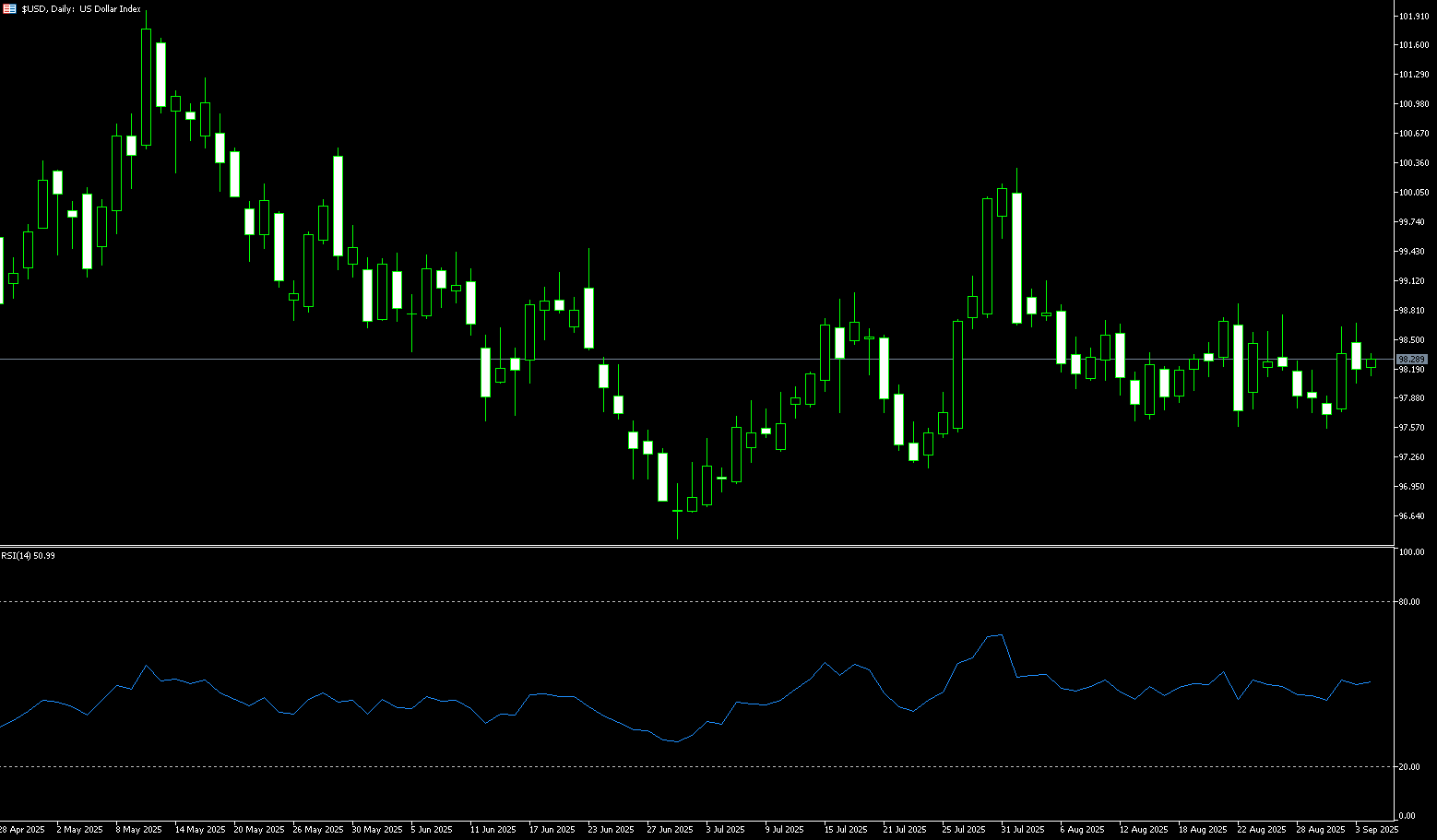

US Dollar Index

The US dollar stabilized during Wednesday's European trading session, rebounding to around 97.80. Expectations of rate cuts weighed on the dollar, and bullish momentum was lacking. Federal Reserve Chairman Powell's comments on Tuesday stabilized the Fed's sentiment index in dovish territory. The Bank of Canada Governor issued a rare warning, signaling a fading of the dollar's safe-haven aura. The dollar had previously received support from cautious comments from Fed officials on Monday. Cleveland Fed President Beth Hammack warned that inflationary pressures are likely to persist in the short term, noting the challenges facing the Fed's dual mandate of controlling inflation and supporting the labor market. She added that with inflation still well above target, caution is warranted in easing policy. Market focus will shift to the Fed's preferred inflation indicator, the August Personal Consumption Expenditures (PCE) price index, which is expected to show easing inflationary pressures.

The US dollar index paused its three-day upward trend during Tuesday's trading session, falling to a low of 97.21. Technical analysis on the daily chart shows that the US dollar index is testing a breakout of a descending channel pattern, suggesting a possible reversal from bullish to bearish. Short-term price momentum is fading, while the 14-day relative strength index (RSI) remains below 50, indicating a persistent bearish bias. Currently, the US dollar index is trading below its 35-day simple moving average at 97.85 and could challenge the 97.00 round number. A break below this level would target the lower Bollinger Band level at 96.80. However, a successful break above the psychologically important 98.00 level would establish a bullish bias and support a test of the 100-day simple moving average at 98.42.

Consider shorting the US Dollar Index at 97.98 today. Stop-loss: 98.100. Target: 97.50, 97.40.

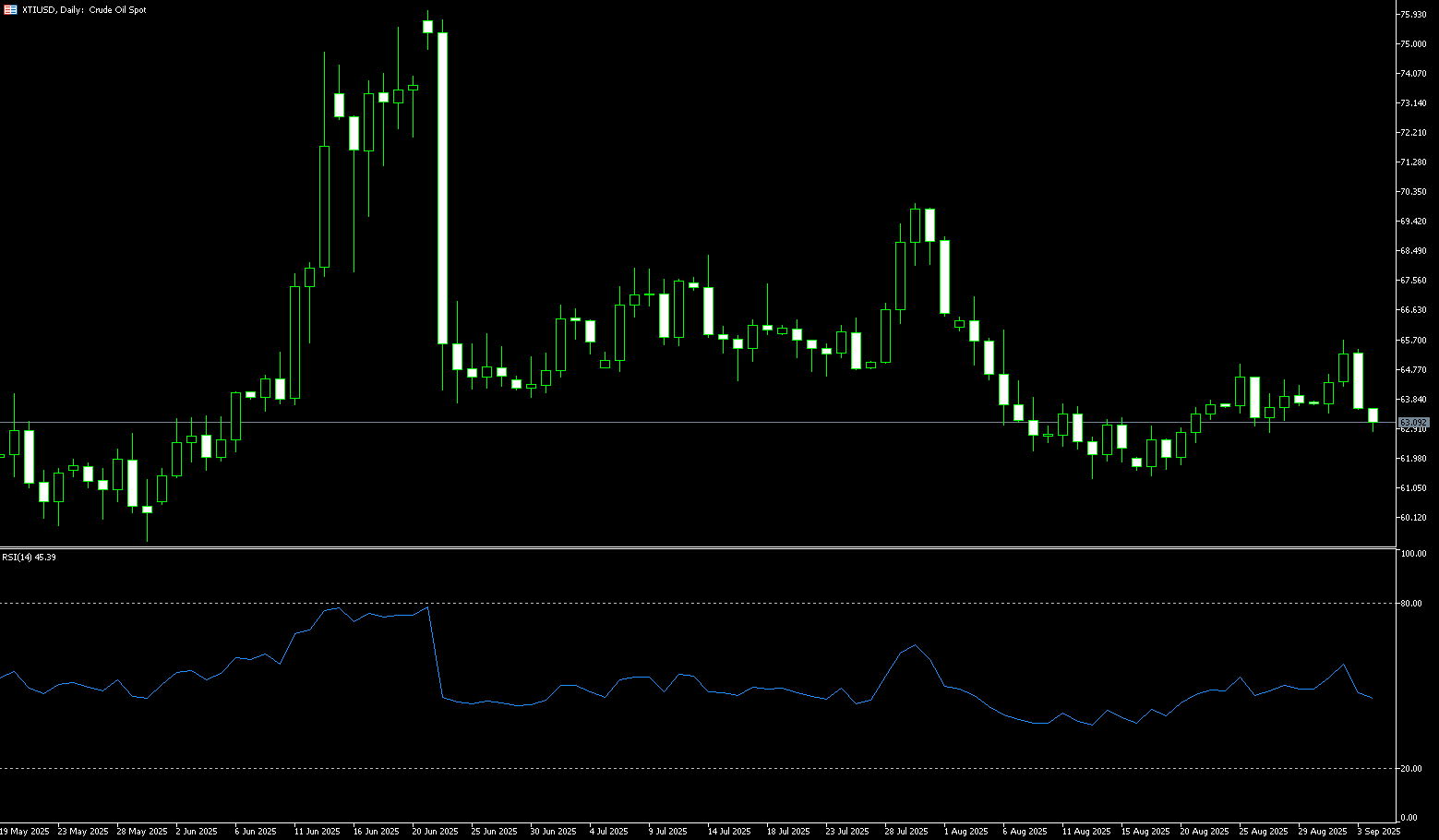

WTI Spot Crude Oil

WTI crude oil rose over 1.76% on Wednesday, nearing $65 per barrel, extending the previous day's 2.0% gain, as US crude oil inventories fell last week, heightening concerns about tightening supply. Data from the US Energy Information Administration showed a 607,000-barrel drop in US crude oil inventories, defying market expectations of an increase. Previously, negotiations to restart oil exports from Iraqi Kurdistan had stalled, with two major producers demanding debt repayment guarantees and pipeline shipments to Turkey suspended since March 2023. Geopolitical risks also continued to support prices, with NATO pledging a "robust" response to Russian airspace violations and Ukrainian drone attacks on Russian refineries and pipelines. Furthermore, Chevron will only export half of the 240,000 barrels per day (bpd) of crude oil produced by Venezuela and its partners. New US authorizations in July allow operations in sanctioned countries but restrict exports of heavy crude oil to the US. The current rise in oil prices is not driven by improved demand, but rather by supply disruptions. Overall, oil prices remain supported in the medium and short term, but volatility will increase, and we should be wary of short-term shocks from data releases.

Technically, WTI prices remain volatile, hovering just above $63.00. In the short term, prices are trading above the 5-day moving average of $62.94, indicating some upward momentum. Key support currently lies at the lower line of the "horizontal channel" at $61.40. A break below this could trigger a further correction to last week's low of $61.00. Above this, $65.61 (the 50.0% Fibonacci retracement level from $70.02 to $61.20) presents significant resistance. A break above this level could propel oil prices into a new uptrend towards the 200-day moving average of $66.55.

Consider going long on crude oil at 64.50 today. Stop-loss: 64.30, targets: 65.50, 66.00.

Spot Gold

Spot gold fluctuated at low levels in early European trading on Wednesday, currently trading below $3,740/oz. On the one hand, continued expectations of a Fed rate cut have injected strong momentum into the gold market; on the other hand, escalating geopolitical tensions have further fueled investors' safe-haven demand. The gold market is currently experiencing a highly sensitive period. This strong rise in gold prices is primarily driven by the simultaneous power of two core drivers: safe-haven demand fueled by geopolitical tensions and the market's firm bet on continued Fed rate cuts. In summary, gold's historic surge not only demonstrates its resilience despite the stability of traditional correlated assets like the US dollar, but also serves as a prime target for fund rotation as concerns about overvalued stock markets emerge. While technical adjustments may lie ahead, gold's shining moment remains amidst lingering global uncertainty and a shift toward easing monetary policy.

Looking ahead, the continuation of gold's upward trend will depend closely on key economic data and the evolution of macroeconomic uncertainty. The daily chart shows that gold's upward trend remains intact, but bulls appear reluctant to push prices above $4,000 in the short term. The 14-day Relative Strength Index (RSI) is at an extremely overbought level of 79.00, indicating bullish momentum, though somewhat weakened. On the downside, a break below $3,750 could lead to support at the $3,700 level and subsequently to $3,650. On the upside, if buying pushes gold above Tuesday's record resistance of $3,791, it would open the way to a test of the all-time high of $3,800. If this resistance level falls, the next target would be $3,850.

Consider going long on gold at 3,733 today, with a stop-loss at 3,728 and targets at 3,755 and 3,765.

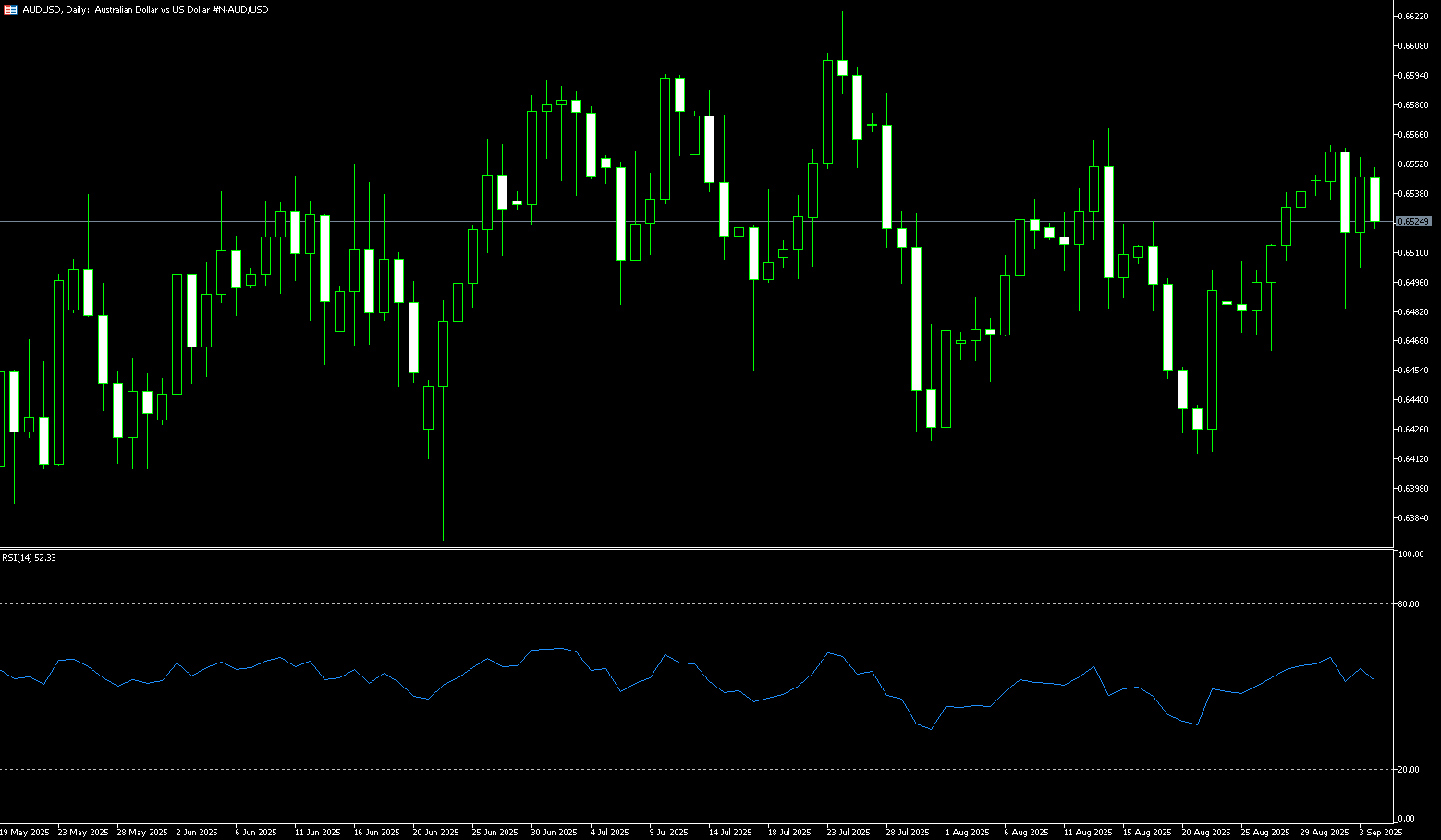

AUD/USD

Australia's consumer price index rose 3.0% in the year to August, following a 2.8% increase reported in July, according to the latest data released by the Australian Bureau of Statistics on Wednesday. The Australian dollar attracted some buying following the release of the employment data, trading at 0.6620. The Australian dollar appreciated above around $0.6600 on Wednesday, following a quiet day as investors digested an unexpected increase in consumer prices in August. The data maintained expectations that the Reserve Bank of Australia would maintain interest rates at 3.6% at its September meeting. Earlier this week, Reserve Bank of Australia Governor Michelle Bullock expressed confidence in the trajectory of inflation, stating that inflation is expected to return to target as the labor market remains resilient. Taken together, the data suggests there is no immediate urgency for action, reinforcing the view that the central bank will maintain a cautious stance on policy adjustments in the near term.

AUD/USD traded slightly below 0.6600 on Wednesday. Technical analysis on the daily chart shows that the pair remains slightly below an ascending channel pattern, suggesting a weakening bullish bias. However, the 14-day relative strength index (RSI) remains slightly above the 50 level, indicating that bullish sentiment remains. The pair is testing immediate resistance at its 9-day simple moving average at 0.6632, followed by the September 18 high near 0.6660. A break below this level would support short-term price momentum and bring the pair closer to the 11-month high of 0.6707 reached on September 17. On the downside, AUD/USD could find initial support at the key level of 0.6600. A break below this support zone would weaken medium-term price momentum and exert downward pressure on the pair, causing it to linger around the 55-day simple moving average at 0.6540.

Consider a long position on the Australian dollar at 0.6470 today. Stop-loss: 0.6460, target: 0.6620, 0.6630.

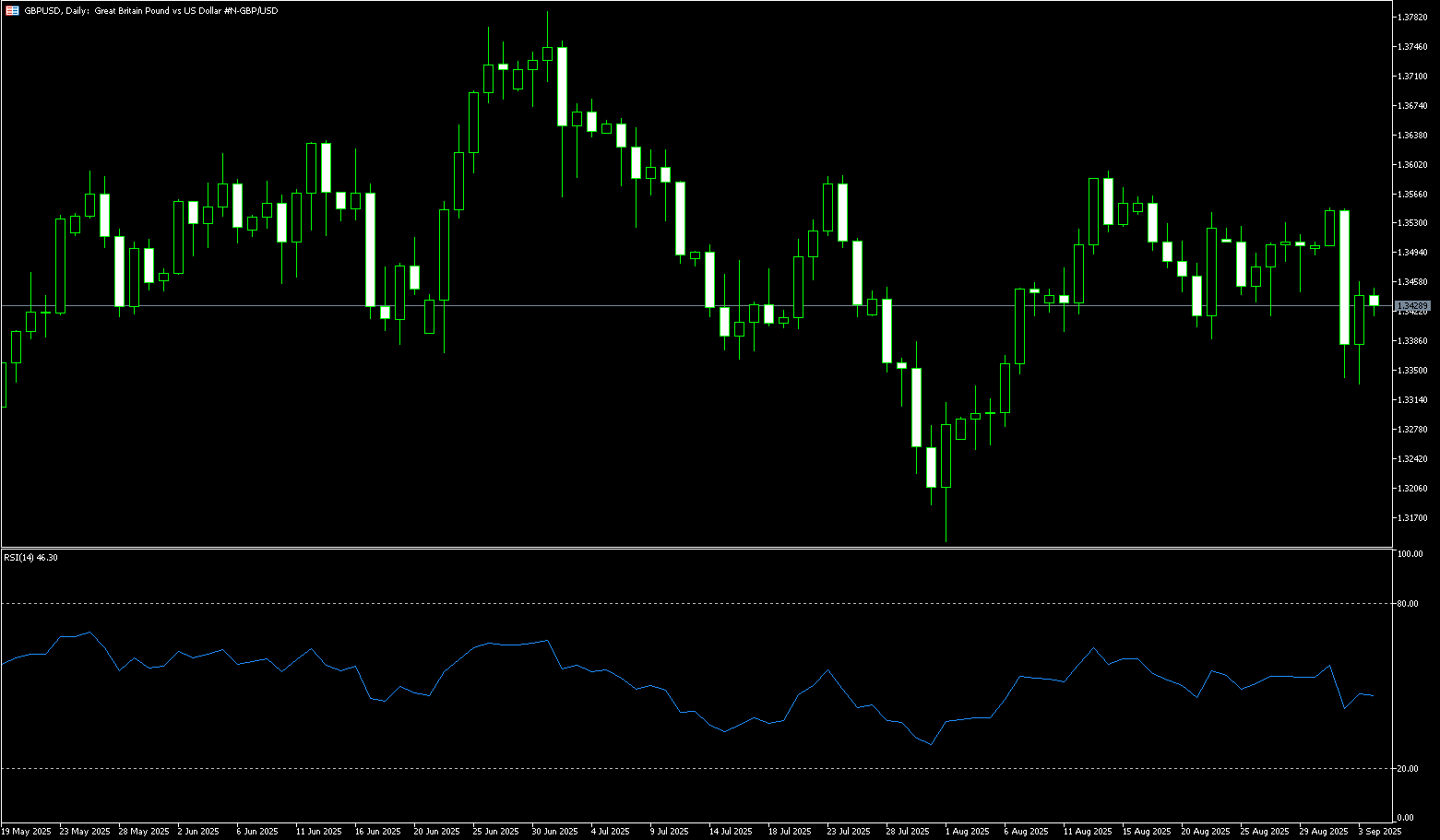

GBP/USD

GBP/USD fell below 1.3500 during Wednesday's European morning session. The pound weakened against the dollar due to weak S&P Global Purchasing Managers' Index (PMI) data from the UK. UK private sector economic activity expanded at a slower pace in September than in August, with the S&P Global Composite Purchasing Managers' Index (PMI) falling from 53.5 to 51. This reading was below expectations of 52.7. Furthermore, the manufacturing PMI fell to 46.2 in September from 47.0 the previous month, while the services PMI dropped from 54.2 to 51.9 over the same period. Federal Reserve Chairman Jerome Powell said on Tuesday that US policymakers continue to grapple with the dual threat of potentially high inflation and a slowing labor market, calling it a "challenging situation." Powell stated that interest rates are well-positioned to address both threats, suggesting he is in no rush to cut them significantly. Powell's cautious comments could boost the US dollar in the short term.

On the daily chart, GBP/USD's rebounds this week have been capped by resistance at the 14-day SMA (most recently at 1.3548), leading to further pullbacks below 1.3500. The pair is currently consolidating between 1.3426 (September 24 low) and 1.3482 (40-day SMA). Traders have been unable to push the pair above last week's 14-day SMA of 1.3548. Success would pave the way for a challenge to the psychologically important 1.3600 level and beyond. Conversely, the lack of upward follow-through suggests buyers are reluctant to open new long positions. Conversely, if GBP/USD breaks below the 40-day SMA of 1.3482, sellers could push the price towards this week's low of 1.3426 (September 24 low), followed by the round-figure level of 1.3400.

Consider going long on the British pound at 1.3432 today, with a stop-loss of 1.3420 and targets of 1.3480 and 1.3490.

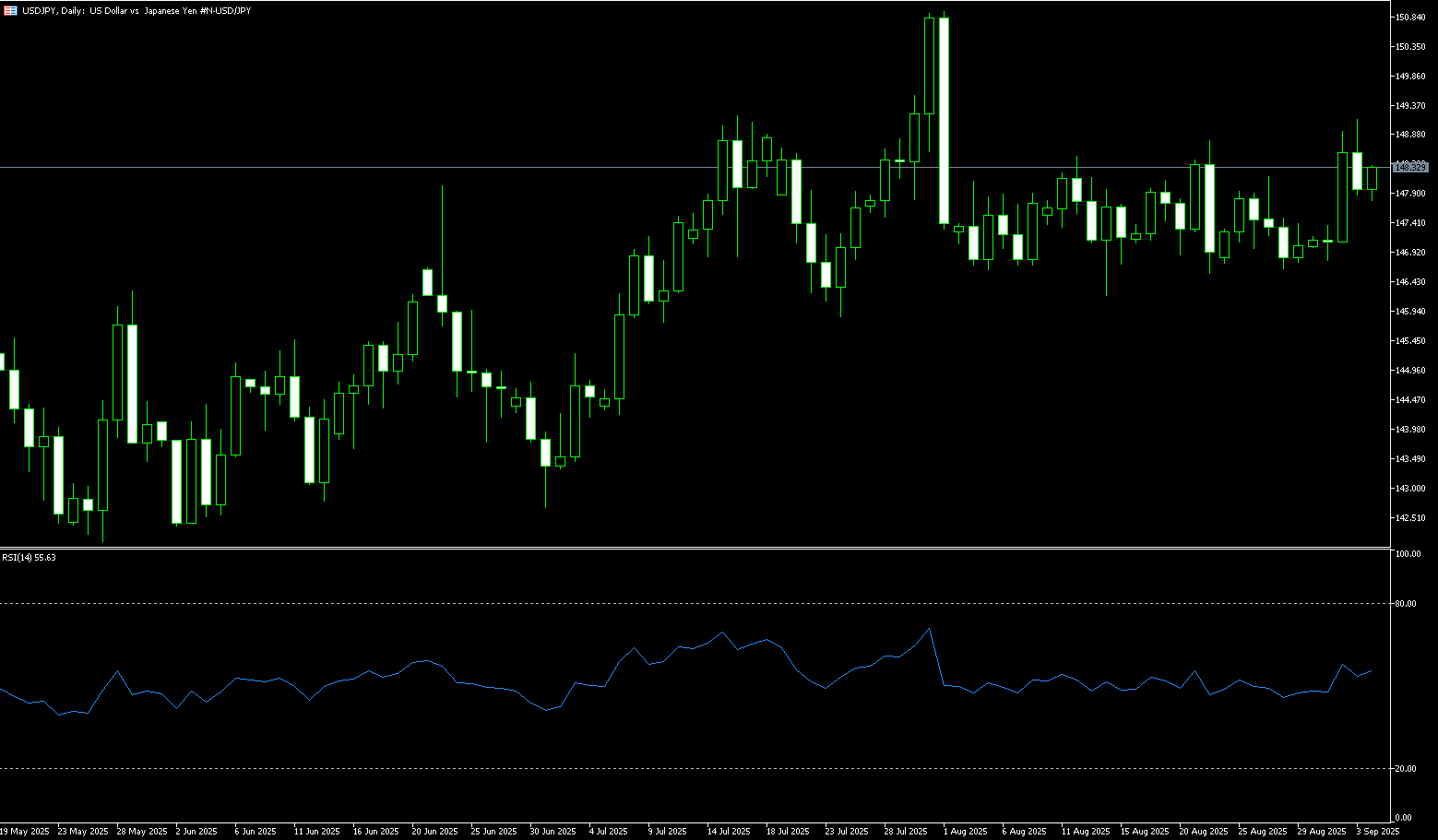

USD/JPY

The USD/JPY exchange rate rose to around 148.90 in early trading on Wednesday. USD/JPY remained stable as traders continued to assess mixed comments from Federal Reserve officials, while key indicators of US business activity slightly disappointed investors. Federal Reserve Chairman Powell stated on Tuesday that labor market weakness outweighed concerns about stubborn inflation, leading him to support the decision to cut interest rates at last week's September meeting. However, Powell further indicated that he was comfortable with the current policy path, although he hinted at the possibility of further rate cuts if the Federal Open Market Committee deems further easing necessary. On the other hand, political uncertainty in Japan, following the resignation of Prime Minister Shigeru Ishiba, could weigh on the yen and create tailwinds for the currency pair. The Liberal Democratic Party leadership election will be held on October 4th, and the outcome could influence the timing of the Bank of Japan's next rate hike if a more dovish candidate is elected.

Global risk assets remain strong, and risk-on sentiment has weakened the yen's safe-haven appeal. On the geopolitical front, the escalating conflict between Russia and Ukraine, NATO's accusations of Russian airspace violations, and tensions in the Middle East are fueling a potential return of risk aversion, maintaining some support for the yen. In the short term, the USD/JPY's performance at the 147 level will be crucial in determining the balance of power between bulls and bears. In the short term, support is found near the 147.20-147.00 range. A break below the key support level of 147.00 could lead to further declines to 146.77 (the September 18 low), after which the spot price will continue its downward trend towards the 146.00 level. Upward resistance initially lies at 149.00 (the round number), but a break above that opens the door to a potential move towards the psychologically challenging 150.00 level.

Consider shorting the US dollar at 149.15 today. Stop-loss: 149.30, target: 148.20, 148.00.

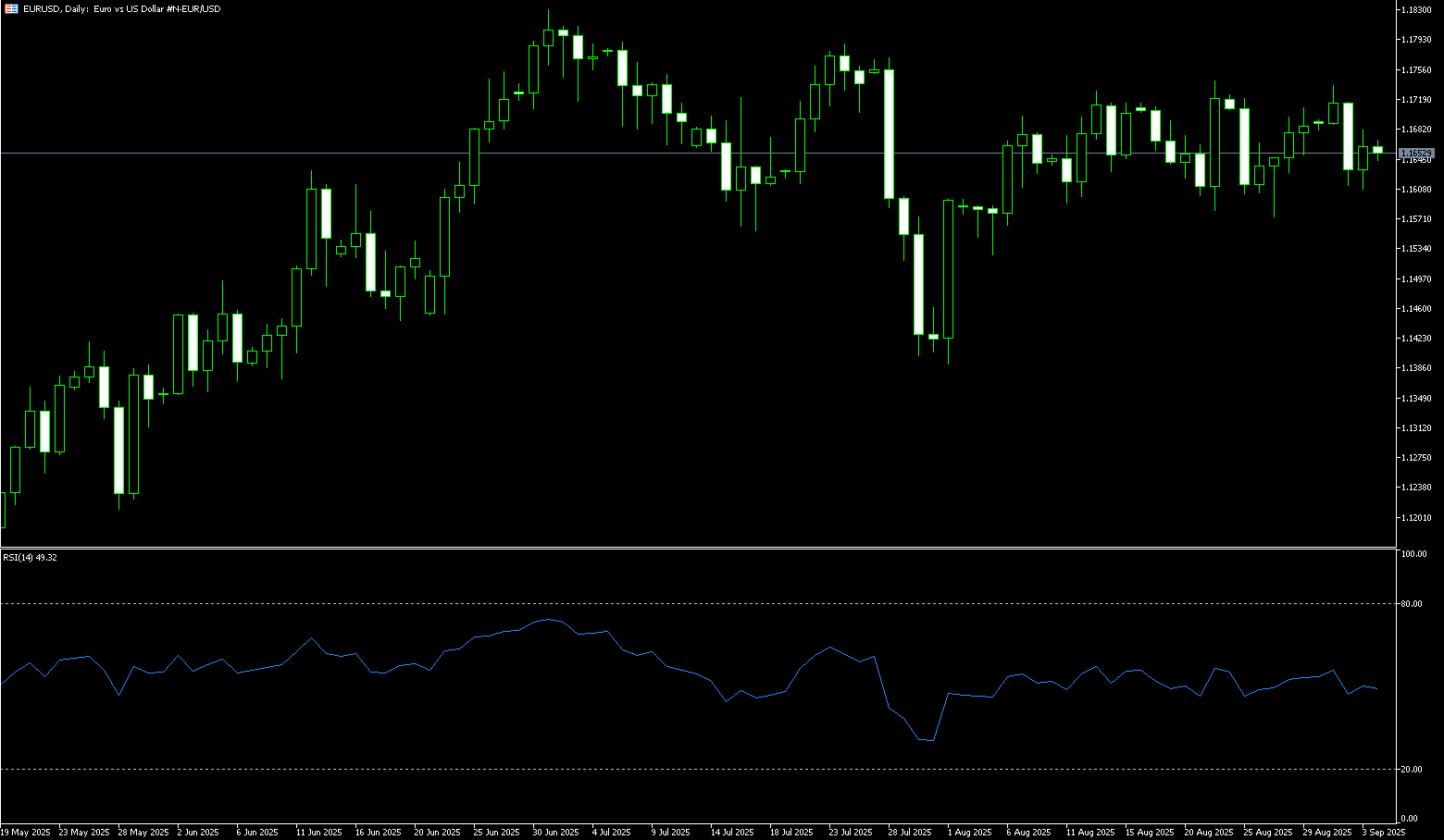

EUR/USD

EUR/USD slipped slightly below 1.1800 during Wednesday's trading session, snapping a two-day winning streak. The decline in the major currency pair was pressured by a rebound in the US dollar following comments from Federal Reserve Chairman Jerome Powell. Fed Chairman Powell struck a cautious tone on Tuesday regarding further easing, providing some support for the dollar. Powell stated that the US central bank needs to continue balancing the competing risks of high inflation and a weak job market in its upcoming policy decision. He further noted that policymakers may face a difficult path when considering further rate cuts. Across the Atlantic, political uncertainty and recession fears in France, the eurozone's second-largest economy, could put pressure on the euro.

The HCOB French Composite Purchasing Managers' Index (PMI), compiled by S&P Global, fell to 48.4 in September from 49.8 in August. This figure marks the sharpest contraction in five months. EUR/USD's uptrend remains intact, with a brief "piercing head" candlestick pattern forming, pushing the pair back above 1.1800. Despite reaching a weekly high of 1.1820, EUR/USD's performance was lackluster, with buyers failing to push the price to test 1.1848 (September 18 high) and subsequently the yearly high of 1.1918. The 14-day Relative Strength Index (RSI) remains flat in bullish territory. Despite its positive reading, a lack of volatility could keep EUR/USD trading sideways. On the downside, a break below 1.1721 (25-day simple moving average) would open the door to further declines. Initial support is seen at 1.1700, followed by the 80-day simple moving average at 1.1655.

Consider a long position on EUR at 1.1726 today, with a stop-loss at 1.1715 and a target at 1.1770 or 1.178.

Disclaimer: The information contained herein (1) is proprietary to BCR and/or its content providers; (2) may not be copied or distributed; (3) is not warranted to be accurate, complete or timely; and, (4) does not constitute advice or a recommendation by BCR or its content providers in respect of the investment in financial instruments. Neither BCR or its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

More Coverage

Risk Disclosure:Derivatives are traded over-the-counter on margin, which means they carry a high level of risk and there is a possibility you could lose all of your investment. These products are not suitable for all investors. Please ensure you fully understand the risks and carefully consider your financial situation and trading experience before trading. Seek independent financial advice if necessary before opening an account with BCR.